Tax invoice is an important documentary evidence which VAT (Value Added Tax) registrants must generate for people who pay for their goods or services. This is to show value of the goods or services, and VAT which the registrant collects or shall collect from the customers every time when they pay for the goods or service. The registrant must generate at least 2 papers of tax invoice – the registrant must give the original one to the customers and the registrant must keep the copy as a supporting evidence of tax returns for at least 5 years since making such report.

If your business in Thailand is registered in the VAT system, you and your Thai accountant need to pay attention to the tax invoice you receive from vendors.

When you buy goods from someone who is also registered in the VAT system, they need to issue a tax invoice right when the goods are delivered. The “tax invoice” may or may not be on the same paper as “invoice” or “delivery note” or “receipt”. If they are not registered in the VAT system, they cannot issue a tax invoice and must not collect VAT from you.

When you buy services, the vendors do not need to issue a tax invoice until you pay them. If you get a credit term on the transaction, they may send you an “invoice” to let you know how much you owe them. When they get paid, they need to issue a receipt and a tax invoice, which could be on the same paper.

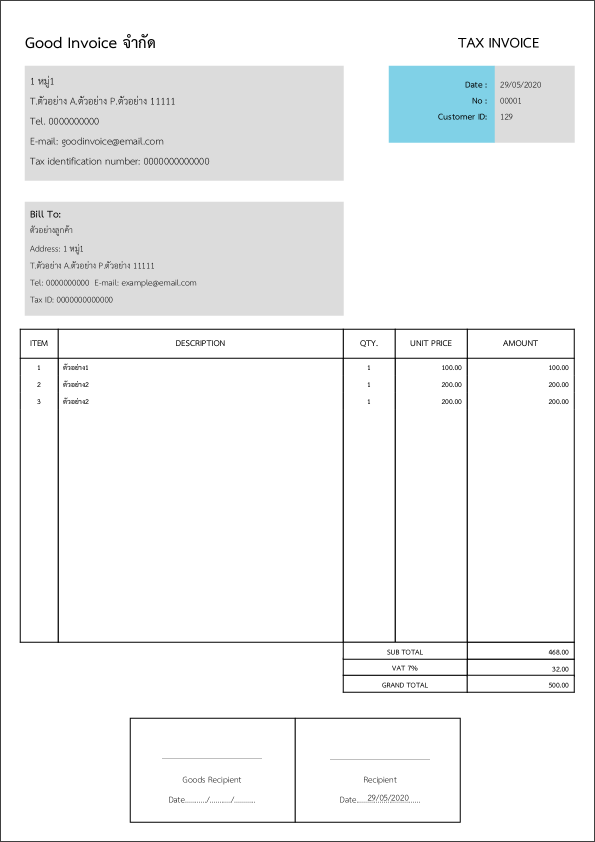

A tax invoice must at least contain the following particulars-

(1) the word “tax invoice” at a prominent place;

(2) the name, address and taxpayer identification number of the business issuing the tax invoice;

(3) the name and address of the purchaser of goods or service;

(4) serial number of the tax invoice;

(5) description, type, category, quantity and value of goods or services

(6) the amount of value added tax calculated on the value of goods or services which is clearly separated from the value of goods or services;

(7) the date of issuance;

(8) any other particulars as prescribed by the Director-General of the Revenue Department.

Please make sure there is no correction made anywhere in the tax invoice even if someone has initialed it. THAI ACCOUNTANT recommends you ask the issuer to issue a new one for you if there are any mistakes on the tax invoice.

For a full version of Thailand Value Added Tax (VAT), visit this page: http://www.rd.go.th/publish/37718.0.html

credit: MSNA Group